Here’s a quick primer on market conditions from our Investment Research wing, to help you make informed portfolio decisions.

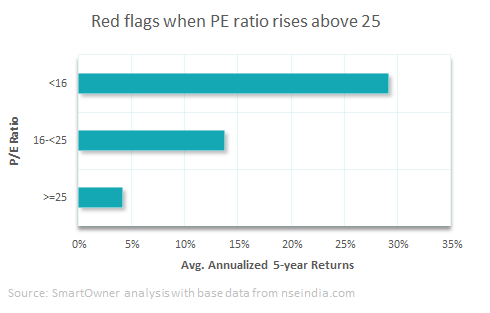

The current Nifty 500 P/E ratio is still at 29+, suggesting depressed returns from stock markets over the next few years. To understand this, let’s take a look at how the Indian stock market has performed in the past when P/E ratios were high.

The chart below shows the average 5-year total return of the Nifty 500 based on different starting P/E ratios over the past two decades. As you can see, when the P/E ratio is 25 or more, investors make low single-digit IRRs over the next 5 years. At the current levels, it could be even lower.

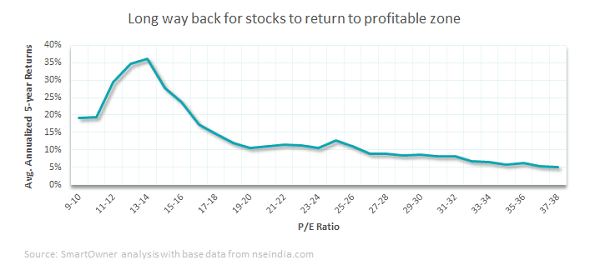

To have a more detailed representation of the above chart, let’s take a look at the rolling 5-year returns of Nifty 500 over the past 20 years at each level of the P/E ratio. We can see that there is a very clear downward trend – the higher the P/E ratio, the lower the IRRs that investors can expect in the future. (As can be seen, the best time to invest in the stock market is when the P/E ratio is around 14.)

In conclusion: In the current inflated-P/E environment, investors may be best served if they exit their equity investments and park their money in assets that offer better prospects, such as the SmartOwner Capital Growth Fund.