Backed by strong growth in India’s services sector, commercial real estate is experiencing an unprecedented boom. With annual office space leasing expected to be over 35 million square feet over the next few years, the largest cities of India are set to enjoy commercial property demand higher even than the United States, and behind only China.

With the advent of digital marketplaces, REITs, and AIFs, these assets are no longer the exclusive domain of institutional investors. A large number of retail investors have begun to participate in this sector with a variety of investment goals. As always with a novel asset type, investors have a few misconceptions about commercial property investments and how to evaluate them.

Having helped hundreds of clients build portfolios of commercial assets that have yielded best-in-class IRRs, we have collected here the top 5 points of misconceptions we see among investors about commercial real estate and explain what you need to know to invest wisely in this sector.

Misconception 1: The total return from owning an office has three parts: rental yield + rent escalations + asset price appreciation.

Understanding the components of your returns is critical, because there is a possibility that some aspects of returns might be counted twice incorrectly, like in this case. Commercial properties are sold based on a “cap rate”, which is simply the capitalized value of current net operating income (rents minus expenses). When rents go up, their capitalized value, which is the property price, also goes up. In other words, the return that we count as rent escalation is actually the same return that is resulting in asset values going up, so we cannot count both.

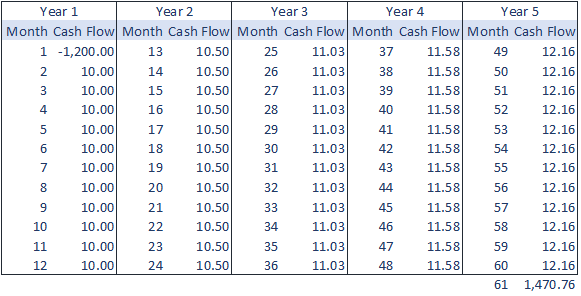

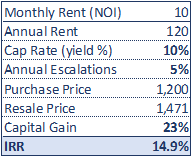

Take the example given below, where a property has an annual rent of Rs.120 and was purchased today for a cap rate of 10, which means it was purchased at Rs.1200. To make the calculations easy to follow, let us assume that the property has annual rent escalations of 5%. So, after one year, this property will have annual rents of Rs. 126 and, if we were to sell it, we would get a price of Rs.1260 at the same cap rate of 10, which is an appreciation of 5% in its price. Let’s now look at the IRR of this investment over a period of 5 years. As you can see in the illustration below, the capital gains and increase in rent together contribute to the 5% extra IRR, and the total IRR of this opportunity is actually 15% (10 plus 5). Even though the pure capital gains achieved over 5 years is 23%, this should not be added to the total IRR.

Detailed cash flow of the investment

Summary of the investment

Misconception 2: Rent escalations of 15% every 3 years is equal to 5% per year.

15% over 3 years actually translates to around 3.5% per year. It is important to remember that when the rent goes up by 15% every 3 years, you get no escalations for 3 years, so you lose out on annual rent increases compared to an annual rent escalation clause in the lease. This is a permanent loss of potential income, which makes a 15% rent increase every 3 years equivalent to less than inflation rates.

Misconception 3: If the property price is 100, and my rent is 8, then my cash yield is 8%, which is a rather healthy number that I can be happy with.

The calculation of cap rate is another point of confusion we see commonly. Cap rate is not simply annual rent divided by property price. It is the annual net operating income divided by property cost. Net operating income takes annual rent and subtracts operating and other expenses, such as insurance and property tax. While these can be significant, the biggest potential cost is vacancy cost as commercial property tends to take a long time to be leased should a vacancy arise. In a country like India, another important cost is the registration cost of the property. Once we take all these costs into account, the actual cash flow yield of a rental property tends to be significantly less than the headline rental yield number.

Misconception 4: The property is leased, so I do not have to consider vacancy costs.

Commercial properties take much longer to lease out than residential properties even in good locations. The nature of these assets is such that tenants are making an important decision, and the number of prospective tenants is far less than for residential properties. Therefore, it is not uncommon for properties to lie vacant for months or sometimes even years. A general rule of thumb when calculating the potential returns from commercial properties is to assume a vacancy period of about one month per year over the long run, even if the property is currently tenanted, as your tenant will likely vacate at some point or the other.

Misconception 5: REITs are a good way to earn high returns.

REITs have revolutionized rental property investing and made commercial properties accessible to ordinary investors. But it is important to understand how they fit in one’s portfolio as these investments are not for everyone. Commercial properties can be best thought of as a safe place to park your money where you get steady cash flows and a natural hedge against inflation. In that way, they are an attractive alternative to fixed income investments that do not have an inflation hedge, such as bank deposits and bonds. However, everything comes at a cost and the price you pay for the cash flows from a REIT is that your total returns are likely to not be very high. They are thus a good option for the cash flow part of your portfolio but they are not a good option if your goal is to maximize total return. For long-term investors who wish to maximize returns, a better option may be an AIF that funds commercial property development, as opposed to investing in completed and rent-yielding commercial properties. While these investments tend to be less liquid, their returns tend to be much higher, making them a better option for growing wealth.

Conclusion: Commercial real estate is growing rapidly as an asset class and offers investors multiple ways to profit from it. It is important to understand the economics of this asset so that one can make good investment choices. REITs and AIFs offer two interesting and contrasting ways to allocate one’s portfolio to commercial properties, and done judiciously, they can help you obtain both cash flow and high returns.